•

Broadly interest rate cycle and

inflation cycle have peaked

both in India and globally

• Investors should add duration

with every rise in yields

•

Mix of 10-year duration and

2-4-year duration assets are

best strategies to invest in the

current macro environment.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals

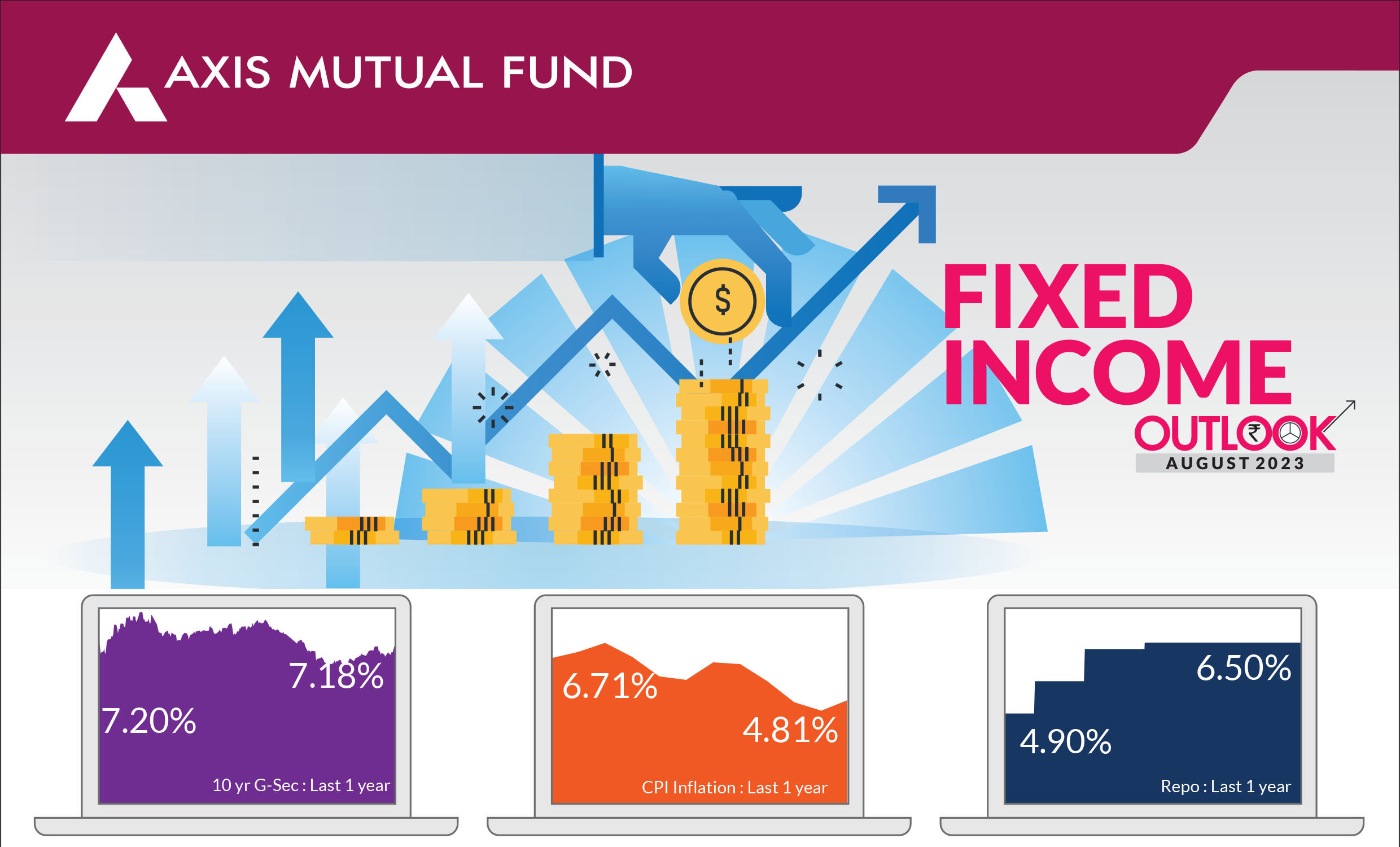

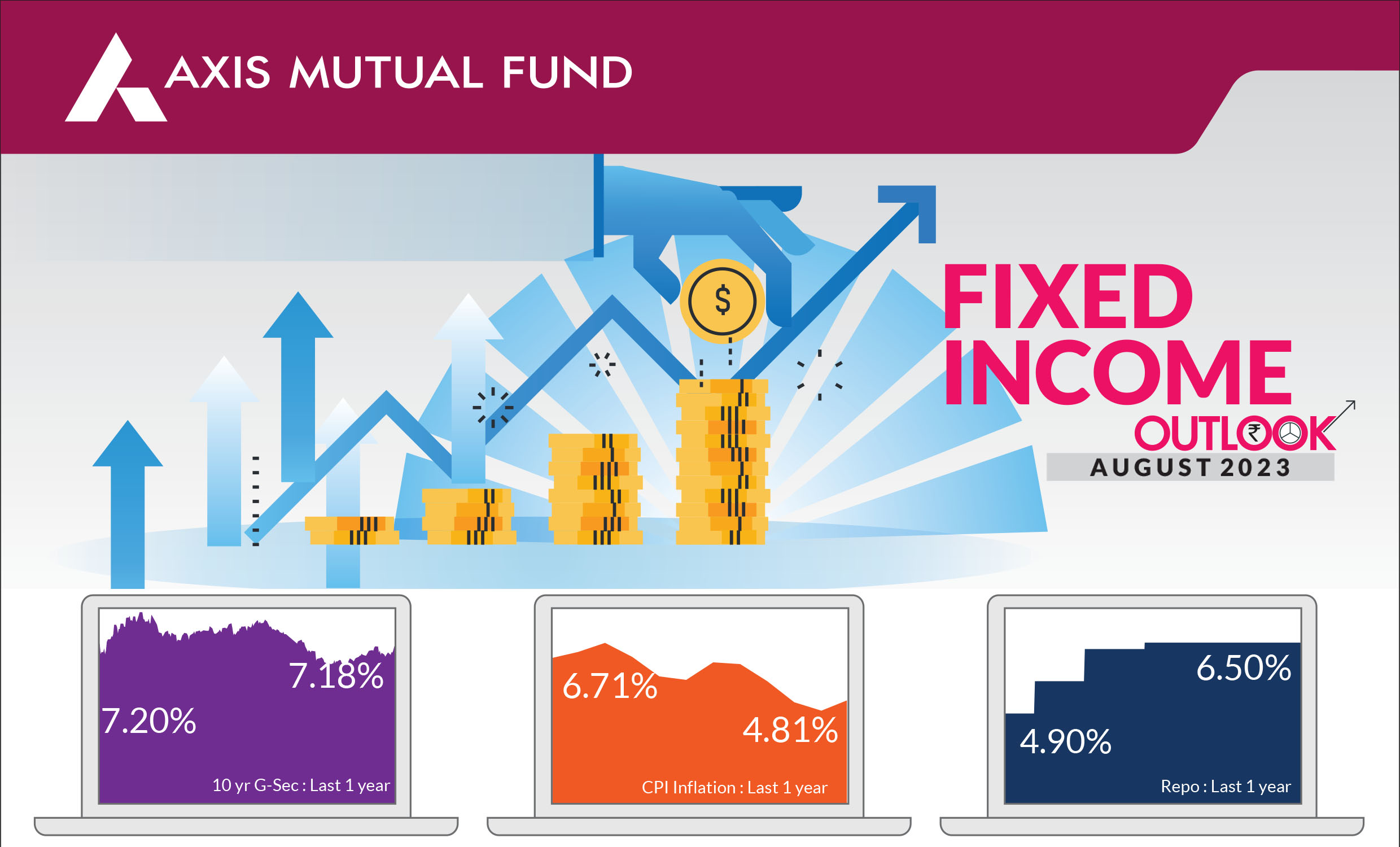

Indian government bond yields traded in a narrow band through most of the month, but rose approx 7-10 basis points primarily due to a combination of mixed data releases from US, actions by the US Federal Reserve (Fed) and the Bank of Japan (BoJ) and soaring commodity / cereal prices. Consequently, the yield on the 10-year benchmark closed 7 bps higher at 7.18%.

► External events lead to rise in bond

yields:

US Treasury yields rose

towards the end of the month, with

the 10-year rising above 4%, after

data releases suggested that the US

economy remained strong. The

numbers defy fears of a recession

despite the Fed's aggressive

tightening. The Fed raised interest

rates by a widely expected 25 bps and we believe incremental hikes would be data

dependent. Separately, the BoJ tweaked the yield control curve by adding

flexibility to raise long term rates if inflation continues higher. Effectively the

upper band of the curve has changed from 0.5% to 1% which could lead to a

strengthening of the yen and an uptick in global bond yields. Indian government

bond yields should not be impacted by this change.

► Higher Inflationary pressures and commodity prices:

Headline inflation climbed

to 4.8% in June, from 4.3% in May due to a sharp rise in vegetable prices. Soaring

tomato, vegetable and cereal prices could push inflation above 6% over the next

two months. However, these should cool off over a period of few months. Core CPI

momentum is softening, with hardly any increase and overall rainfall has been

catching up which gives comfort that inflation would not be a worry for next 12

months. While inflationary risks have increased marginally in near term, we

believe that the Reserve Bank of India's (RBI) monetary policy meeting on 8-10

August may result in a status quo and rates will not be increased. Additionally,

after the Black Sea grain deal being halted by Russia (export of commodities from

Ukraine through the Black Sea), India could see an impact on prices of wheat corn

and edible oils. Last year, due to this deal, prices were very low on account of

increased wheat / corn supplies. Food inflation in India is largely driven by

Minimum Support Prices (MSP) and local monsoons, but an increase in edible oil

prices (largely imported) can drive inflation higher.

► Continued improvement in Monsoon: Total rainfall stood at 7% above long period average driven by pick up in central India and south India. On a cumulative basis, rainfall was deficient in east and north-east India, normal in central India, south India, and excess in north India. A delayed rainfall exacerbated fears of an El Nino and concerns that a deficit in rainfall could lead to higher food prices. The growth of the agriculture and allied services sector is influenced by the monsoon as 51% of the cropped area is monsoon dependent.

► Continued improvement in Monsoon: Total rainfall stood at 7% above long period average driven by pick up in central India and south India. On a cumulative basis, rainfall was deficient in east and north-east India, normal in central India, south India, and excess in north India. A delayed rainfall exacerbated fears of an El Nino and concerns that a deficit in rainfall could lead to higher food prices. The growth of the agriculture and allied services sector is influenced by the monsoon as 51% of the cropped area is monsoon dependent.

Market view

Though headline inflation could be above RBI's comfort zone and real rates post increased food inflation could be ~100 bps, we do not believe that the RBI would really be as concerned. CPI for the year should stay contained around 5.25% and the large increases on account of higher tomato prices should cool off. Another factor favouring inflation over the next 12 months is the catchup in overall rainfall. Accordingly, RBI's tone could be cautious in the upcoming monetary policy and structurally do not believe a hike is on the cards. Furthermore, RBI could lower rates only if growth falls below 5.5% and the Fed lowers its interest rates. If this scenario plays out, we believe RBI would move towards a neutral stance and markets despite no cuts would start pricing in 50 bps cuts.While the Fed has room for one more hike, it is highly unlikely that it would increase rates now. Major indicators are a mixed bag and inflationary pressures are on their way down. Markets expect US inflation to fall to sub 4% one year from now and hike in such a high real rate scenario looks difficult. Moreover, the Fed will refrain from raising rates in light of higher bankruptcies, increasing credit cards defaults and worries of credit tightening leading to massive slowdown. It is pertinent to note that the Fed and markets incrementally believe that probability of recession is almost negligible. In this scenario, unless we see growth shocks the Fed would refrain from lowering interest rates and we see rate cuts not before the first quarter of 2024.

News that China could stimulate the economy gives us comfort that China's near term growth looks weak and this effectively bodes well for commodities. As a result, global growth would remain soft. Our outlook on commodities is still range bound and do not expect any major up move in commodity prices from current levels. Infact China would focus more on consumption led growth rather than infrastructure led growth which would keep commodity prices under check.

Most part of funded (government /corporate bonds) and non-funded (swaps) fixed income curve is pricing in no cuts for the next one year. We believe that we are at peak of interest rate cycles, globally as well as in India and probability of further hikes are limited. We do expect the 10-year bond yields to touch 6.75% by April - June 2024. Investors should use the uptick in yields to increase duration and should stick to short to medium term funds with tactical allocation to long / dynamic bond funds in this macro environment. One can expect yields to be lower by 25-40 bps in next 6-12 months across the curve.

From a portfolio standpoint, in line with our medium-term view, our portfolios currently run duration at the higher end of the respective investment mandates. Our expectations of incrementally softening yields across the curve and a possible policy pivot in favor of softening rates in the latter half of the financial year, this has already been factored into the current portfolio positioning. For investors with a medium-term investment horizon, we continue to believe actively managed duration strategies offer ideal investment solutions to capitalize on a falling interest rate outlook and attractive 'carry' opportunities as compared to comparable traditional investment solutions.

Source: Bloomberg, Axis MF Research.